The Investment Corporation and the Asset Management Company understand that climate change is an important (material) issue that brings about drastic changes to natural environmental conditions and social structures, seriously affecting the Investment Corporation and the Company's operations as well as businesses overall

The Company's (Investment Corporation's) position and basic policy on climate change

The following statements show the Asset Management Company's understanding with respect to the Company's resilience against climate change and climate-related issues.

- Progress in climate change is a scientific fact as indicated mainly by the Paris Agreement (2015), IPCC Special Report (2018) and IPCC Sixth Assessment Report (Working Group 1, 2021). Progress in climate change is an (material) issue that brings drastic changes to natural environmental conditions and social structures, seriously affecting the Asset Management Company's operations and businesses overall.

- The Asset Management Company sets out climate change mitigation and adaptation to climate change in its environmental policies on climate change, one of its material issues.

- Weather and climate disasters, such as the intensification of typhoons and heavy rainfalls, frequent heat waves and droughts, and rising global sea levels, are expected to occur more frequently or spread more broadly due to progress in climate change. This may have a serious impact on the Asset Management Company's business.

- A shift to a decarbonized society and economy is expected to take place as a result of global initiatives for the mitigation of climate change, such as the establishment of a scheme aimed at reducing greenhouse gas emissions, tightening of emission control regulations, etc. The change may have a significant impact on the Asset Management Company's businesses.

- Based on the understanding that the climate change issue represents a systemic risk to financial operations, many stakeholders including investors have been requesting the disclosure of information on risks and opportunities related to climate change. In particular, the Asset Management Company needs to address the serious issue of increasing transparency through the promotion of climate-related risk disclosures according to the recommendations made by the Task Force on Climate-related Financial Disclosures (TCFD).

- The Asset Management Company should enhance the resilience of its businesses by identifying, assessing and managing risks and opportunities that may be brought about by climate change. These efforts are essential from a range of perspectives, including the securing of the Investment Corporation's sustainable and stable profitability on a long-term basis.

Based on this understanding, the Asset Management Company has decided to establish its basic policy and represent its commitment with respect to climate change and resilience. Details are as follows.

The Asset Management Company supports the global targets set forth in the Paris Agreement and will work continuously to reduce greenhouse gas emissions to contribute to the mitigation of climate change.

Announcement of support for the TCFD recommendations (participation in the TCFD Consortium)

HEIWA REAL ESTATE REIT, Inc. (hereinafter referred to as the “Investment Corporation”) announced today that HEIWA REAL ESTATE Asset Management CO., LTD. The Asset Management Company will analyze risks and opportunities related to climate change and climate issues in line with the TCFD recommendations and will disclose its initiatives in a timely manner.

This table can be scrolled sideways.

| Requests | Governance | Strategies | Risk Management | Metrics and Targets |

|---|---|---|---|---|

| Item Details | Disclose the organization's governance regarding climate-related risks and opportunities | Disclose the actual and potential impact of climate-related risks and opportunities on the organization's businesses, strategy and financial planning when such information is important. | Disclose how the organization will identify, assess and manage climate-related risks. | Disclose indicators and goals used when assessing and managing climate-related risks and opportunities when such information is important. |

| Recommended Disclosures | a) Explain the system for the organization's board of directors to supervise efforts to address climate-related risks and opportunities. | a) Explain the short-, medium- and long-term climate-related risks and opportunities identified by the organization. | a) Explain the process the organization uses to identify and evaluate climate-related risks. | a) Disclose the indicators used to evaluate climate-related risks and opportunities in line with the organization's strategy and risk management processes. |

| b) Explain the roles of management in the evaluation and management of climate-related risks and opportunities. | b) Explain the impact of climate-related risks and opportunities on the business, strategic and financial planning of the organization. | b) Explain the process the organization uses to manage climate-related risks. | b) Disclose greenhouse gas (GHG) emissions and related risks in Scope 1, Scope 2 and, if applicable, Scope 3. | |

| c) Explain the resilience of the organization's strategy taking into consideration various climate-related scenarios, including a 2ºC or lower scenario. | c) Explain how the process the organization uses to identify, evaluate and manage climate-related risks is integrated into the organization's general risk management. | c) Explain the goals the organization uses to manage climate-related risks and opportunities and its track record for the achievement of the goals. |

Governance

The Investment Corporation has decided to establish the following governance system to deal with climate-related risks and opportunities pertaining to the Investment Corporation and the Asset Management Company.

- The chief executive officer for climate-related issues shall be a representative director who has the authority to make final decisions in conjunction with the promotion of sustainability.

- The operating officer for climate-related issues shall be the general manager of the Business Planning Division who is responsible for the promotion of sustainability.

- The chief executive officer for climate-related issues shall make decisions on climate change-related initiatives after such initiatives are discussed and reviewed by the sustainability promotion committee.

- The operating officer for climate-related issues shall periodically provide a report about matters related to climate change initiatives, such as the identification and evaluation of the impact of climate change, management of risks and opportunities, progress of initiatives pertaining to adaptation and mitigation, and establishment of metrics and targets, to a chief executive officer for climate-related issues at a sustainability committee meeting.

Under this system, the Representative Director oversees the Investment Corporation's initiatives on climate-related issues.

(Note) For details of the sustainability promotion system, including the position of the Sustainability Promotion Committee, please visit the address below.

https://www.heiwa-re.co.jp/en/sustainability/concept/policy.html

Strategy

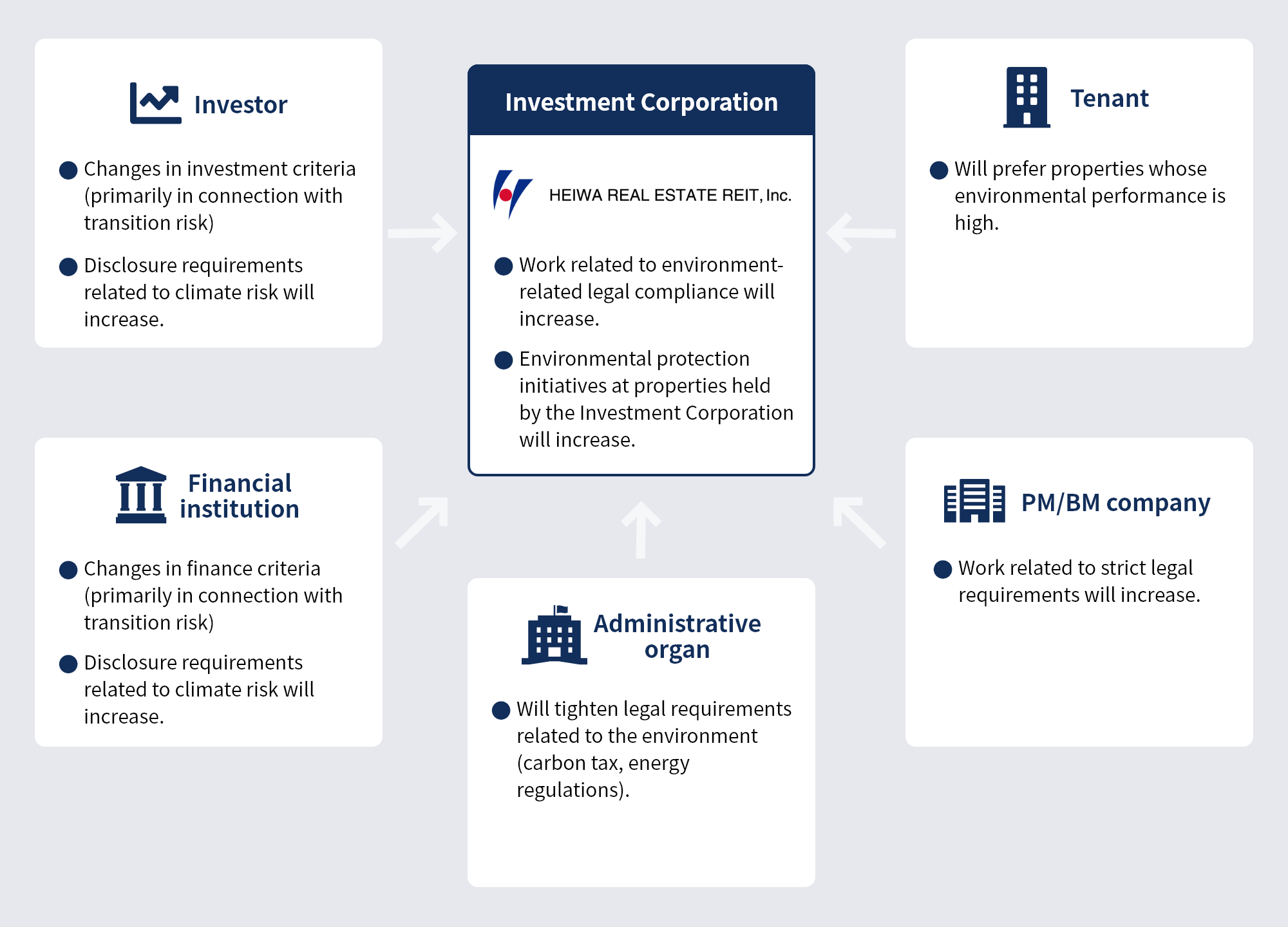

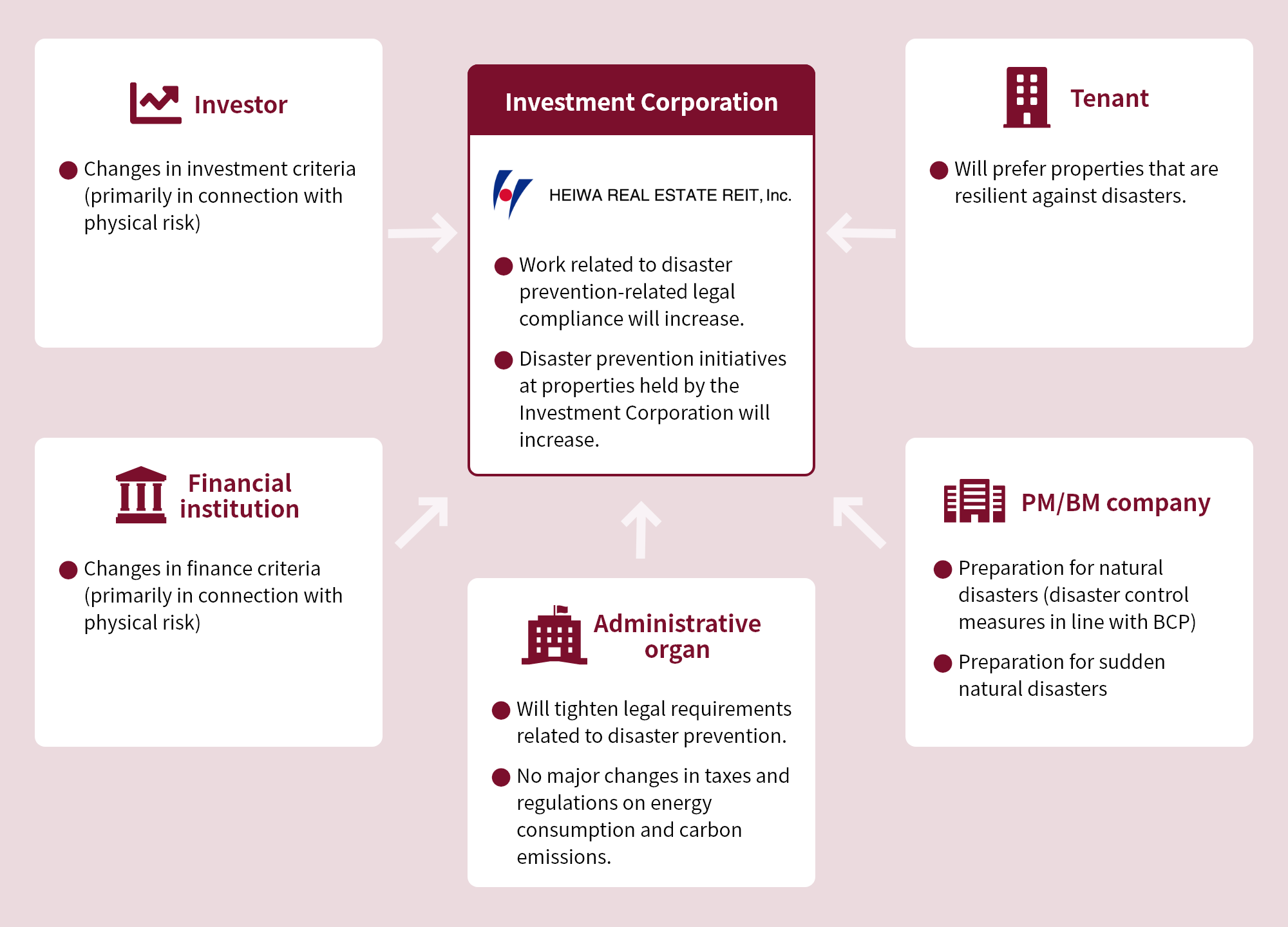

The Asset Management Company will establish a process to identify, evaluate and manage the impact of climate-related risks and opportunities on the management activities, strategies and financial plans of the Investment Corporation, and put the process into use properly. It aims to identify and evaluate climate-related risks and opportunities systematically and objectively by utilizing scientific and academic findings.

(1) Identification of risks and opportunities

At the Asset Management Company, the Sustainability Promotion Committee has examined and discussed climate-related risks that could have financial effects and has identified the climate-related risks and opportunities shown below.

This table can be scrolled sideways.

| 4°C scenario | 1.5°C scenario | ||||||||||||||||

| Real estate management | Financial impact on the fund | Time span |

Risk management, countermeasure, initiative | Possibility of occurrence |

Financial impact | Possibility of occurrence |

Financial impact | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Short term |

Medium term |

Long term |

Short term |

Medium term |

Long term |

Short term |

Medium term |

Long term |

Short term |

Medium term |

Long term |

||||||

| Transition risks |

Policy and Law | Toughening taxation on introduction of a carbon tax and GHG emissions regulations | Increasing taxes, including a carbon tax, and credit purchases | Short term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | High | Small | Medium | Large |

| Tightening of laws and regulations, more stringent obligations |

Increasing renovation expenses, decreases in the profitability and asset value of low-performance buildings, surcharges due to the tightening of laws and regulations Increasing business expenses, including payments to outside agencies to meet requirements for reporting |

Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | High | Small | Medium | Large | ||

| Mandatory building energy performance labeling | Certification expenses and surcharges incurred | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | Medium | Small | Medium | Medium | ||

| Technology | Evolution and promotion of renewable energy and energy saving technologies |

Increasing equipment replacement expenses due to equipment obsolescence at properties owned by the fund Decreases in occupancy rate and profitability due to changes in tenant criteria, including the presence or absence of EV chargers and other equipment |

Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Low | Medium | Small | Small | Medium | |

| Market | Introduction of environmental performance standards, among other standards, in real estate appraisal | Decrease in the NAV (net asset value) of the fund | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | Medium | Small | Medium | Medium | |

| Worsening funding conditions for market participants that have not responded to climate change | Rising funding costs | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | Medium | Small | Medium | Medium | ||

| Rising utilities expenses (including expenses for renewable energy procured from outside sources) | Increasing business expenses | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | Medium | Small | Medium | Medium | ||

| Changes in demand from tenants (choosing properties that have responded to climate change, avoiding properties that have not responded to climate change) | Decrease in rent income due to the difficulty in attracting new tenants and a decline in retention rate | Short term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | Medium | Small | Medium | Medium | ||

| Investors' more stringent ESG investment criteria | Downward pressure on investment unit prices, less liquidity | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | Medium | Small | Medium | Medium | ||

| Physical risks |

Acute | Damage to properties caused by typhoons, storm surges, torrential rains, river flooding, landslides, etc. |

Increasing repair expenses and insurance premiums Declines in occupancy rate due to increases in tenants moving out of properties, decreases in rent, increases in accounts receivable |

Short term |

|

Low | Low | Medium | Small | Small | Medium | Low | Low | Low | Small | Small | Small |

| Chronic | Flood damage to properties located in low-lying places due to sea level rises | Expenses for large-scale renovations (raising flood barriers) incurred | Long term |

|

Low | Low | Medium | Small | Small | Medium | Low | Low | Low | Small | Small | Small | |

| Increasing demand for air-conditioning due to increases in extreme climatic conditions, such as extremely hot and cold days | Increases in air-conditioning maintenance and repair expenses | Short term |

|

Low | Low | Medium | Small | Small | Medium | Low | Low | Low | Small | Small | Small | ||

| More frequent and severer natural disasters due to climate change | Increasing repair expenses, and insurance premiums, declines in occupancy rate due to increases in the number of tenants moving out of properties, decreases in rent, increases in accounts receivable | Medium term |

|

Low | Low | Medium | Small | Small | Medium | Low | Low | Low | Small | Small | Small | ||

| Opportunities | Resource efficiency | Introduction of renewable energy on the premises | Reduction in expenses for utilities procured from outside sources | Short term |

|

Low | Low | Low | Small | Small | Small | Low | Low | Medium | Small | Small | Medium |

| Increasing properties owned by the fund that have high energy efficiency and environmental performance | Reduction in utilities expenses | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Low | Medium | Small | Small | Medium | ||

| Products and services | Providing low-emission facilities and services and communicating them to tenants and users | Increase in revenue by attracting tenants | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Low | Medium | Small | Small | Medium | |

| Market | Preference for properties with a high energy saving performance | Raising rent, increases in revenue due to increases in occupancy rate and utilization rate | Medium term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | High | Small | Medium | Large | |

| Preference for properties with a high preparedness for disasters | Medium term |

|

Low | Low | Medium | Small | Medium | Medium | Low | Low | Low | Small | Small | Small | |||

| Finding new investors |

Developing a framework for sustainable financing (including green bonds) and implementing sustainable financing Increasing funds raised and reducing funding costs by attracting the attention of investors and lenders that emphasize environmental issues |

Short term |

|

Low | Low | Low | Small | Small | Small | Low | Medium | Medium | Small | Medium | Medium | ||

| Investors' more stringent ESG investment criteria | Upward pressure on investment unit prices, more liquidity | Medium term |

Low | Low | Low | Small | Small | Small | Low | Medium | High | Small | Medium | Large | |||

(2)Scenario Analysis

The following scenarios are analyzed.

1.5℃ scenario analysis (reference scenarios: IEA NZE2050 (transition risk), IPCC RCP4.5 (physical risk)

The 1.5℃ scenario involves strict legal and tax requirements to mitigate climate change. In this scenario, a reduction in greenhouse gas emissions will curb temperature increases. Physical risk is relatively low. Transition risk is high.

4℃ scenario analysis (reference scenarios: IEA STEPS (transition risk), IPCC RCP8.5 (physical risk)

The 4℃ scenario is a scenario in which climate change measures will make little difference and no strict legal and tax requirements will be made. In the scenario, natural disasters will increase and severer natural disasters will occur due to increasing greenhouse gas emissions. Physical risk is relatively high. Transition risk is low.

(Note) For specific initiatives on environmental issues, please visit the address below.

https://www.heiwa-re.co.jp/en/sustainability/environment/issues.html

Risk management

The Asset Management Company will move forward with initiatives to manage identified climate-related risks and opportunities and raise resilience levels, thereby helping the Investment Corporation reduce business risks and create value creation opportunities. Through such efforts, it aims to secure profitability sustainably and stably on a long-term basis.

- Climate-related risks are set out as ESG-related risks in the risk management regulations. The Compliance & Risk Management Office routinely monitors the management of climate-related risks and reports the results of monitoring to the Compliance Committee and the Board of Directors every three months (April, July, October, and January).

- The Real Estate Investment Department and the Compliance & Risk Management Office of the Asset Management Company perform due diligence on new investments in assets. The Investment Committee and Compliance Committee discuss and approve the investment in consideration of the due diligence. After that, the Board of Directors of the Asset Management Company or the Board of Directors of the Investment Corporation gives final approval to the investment.

- In asset management, the Sustainability Promotion Committee manages risks related to sustainability overall, including climate change risks. Specifically, the committee monitors and analyses environmental performance, including greenhouse gas (GHG) emissions, and discusses countermeasures.

Measurement criteria and targets

- Targets are set for mitigating risks and realizing opportunities and performance against the targets is monitored.

- GHG emissions from the portfolio and emission intensity are key indicators in the real estate sector. Scope 1, Scope 2, and Scope 3 emissions are monitored and compared with the targets set. In this way, the Company continues to strive to reduce GHG emissions. The operating officer for climate-related issues reports progress in each initiative to the Sustainability Committee at least one time each year.

- Climate-related indicators and targets are added and changed according to social and economic conditions and policy measures in Japan and in the world.

(Note) For details of targets and performance data, please visit the address below.

https://www.heiwa-re.co.jp/en/sustainability/environment/index.html