Governance Policy

As a means of strengthening corporate governance, the Investment Corporation and the Asset Management Company will set forth concrete measures and tackle these challenges to promote initiatives aimed at thoroughly enforcing corporate ethics, build a governance structure that ensures third party objectivity and diversity among officers of the Investment Corporation, promote asset management that emphasizes the interests of unitholders, and develop assurances of transparency.

Goals

Conduct corporate ethics training.

- Applies to all executives and employees at asset management companies.

- April 2022: Completed

Create BCP system including pandemic response.

- Period: By end of 2021

Write and publish ESG report.

- Write ESG report and publish on the website.

- First issued in May 2022, continued annually

Corporate Governance

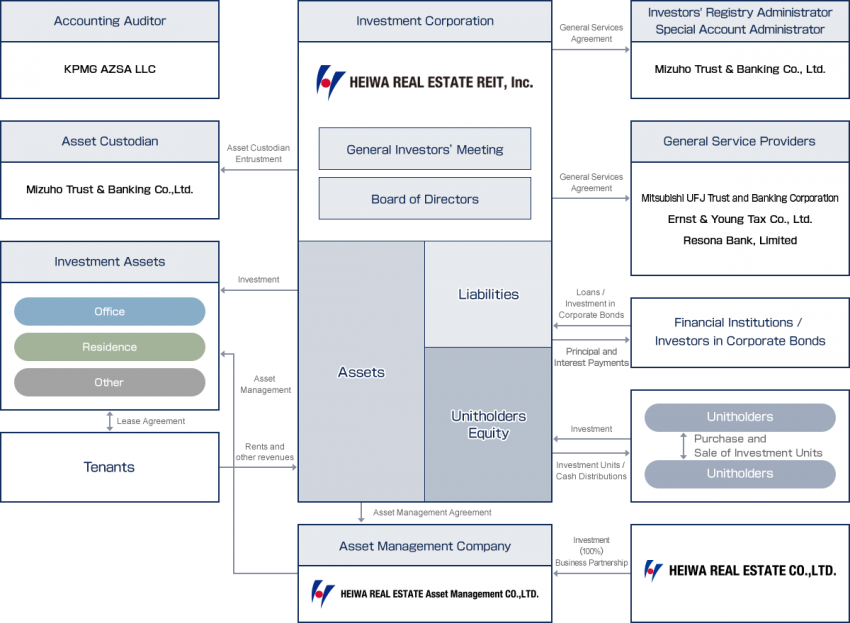

Management of the Investment Corporation’s assets is entrusted to HEIWA REAL ESTATE Asset Management CO., LTD. The Asset Management Company, recognizing that the management operations of the Investment Corporation’s assets comprise management of the capital of the Investment Corporation’s unitholders, determines various regulations and conducts decision-making procedures for the purpose of confirming the status of compliance with laws, regulations and other requirements, and for executing appropriate and fair business management.

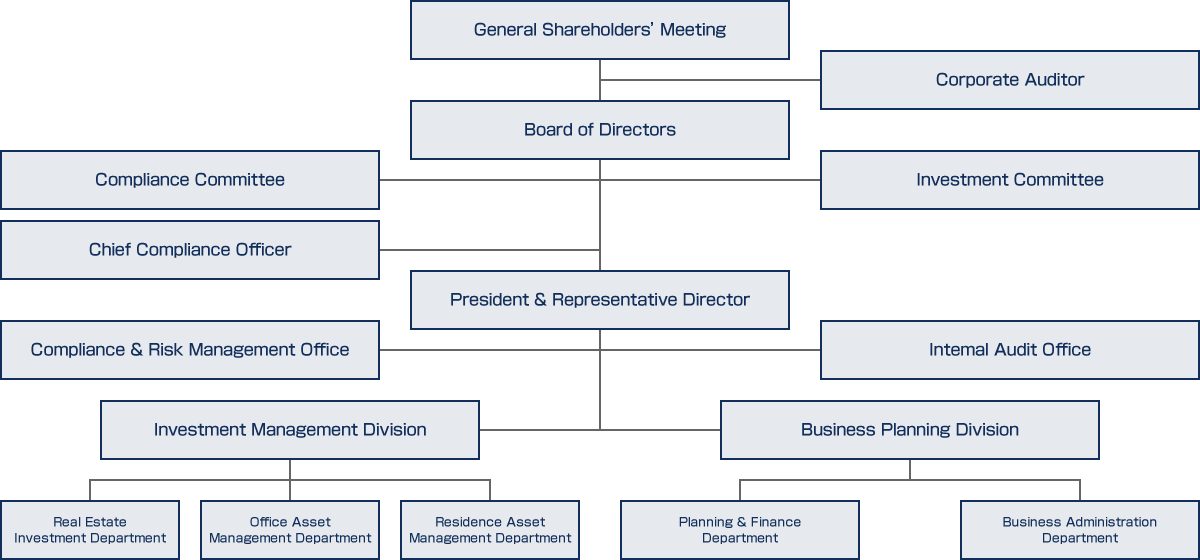

Organization Diagram

For more information, please visit the HEIWA REAL ESTATE REIT,Inc. website.

Management Structure

This table can be scrolled sideways.

| Name of Committee | Overview | |

|---|---|---|

| Board of Directors |

|

|

| Members | Chairperson: President and Representative Director Members: All directors |

|

| Frequency of Meetings | At least once every three months | |

| Investment Committee |

|

|

| Members | Chairperson: General Manager, Investment Management Division Members: President & Representative Director, General Manager of the Business Planning Division, Chief Compliance Officer, General Manager of the Real Estate Investment Department, General Manager of the Office Asset Management Department, General Manager of the Residence Asset Management Department, General Manager of the Planning & Finance Department; in addition to these committee members, when deemed necessary by the chairperson, experts on matters such as real estate investment or appraisal may be appointed as outside committee members. |

|

| Compliance Committee |

|

|

| Members | Chairperson: Chief Compliance Officer Members: President & Representative Director, General Manager of the Business Planning Division, General Manager of the Planning & Finance Department, General Manager of the Business Administration Department, and outside members. Note that an outside member refers to a person who has never been the officer or employee of the Asset Management Company or its shareholders, and is an expert with deep knowledge of compliance-related matters (such as attorney and certified public accountant) who has been appointed as a member based on the approval of the Board of Directors. |

|

| Frequency of Meetings | At least once every three months | |

Criteria for the Appointment of Officers、Compensation

In selecting candidates for director, appointments are made through a resolution of the General Investors' Meeting, on the assumption that they do not fall under any of the grounds for disqualification set forth in various laws and regulations including the Investment Trust Act (Articles 98 and 100 of the Investment Trust Act, Article 244 of the Ordinance for Enforcement of the Investment Trust Act).

The compensation of executive directors and supervisory directors is an amount not exceeding 800,000 yen a month per executive director and 300,000 yen a month per supervisory director, with the specific amounts determined at Board of Directors meetings.

| Title | Name | Gender | Reason for Appointment | Main Skills and Experience | Qualifications Held | Attendance at Board meetings in FP45 - FP46 (Dec.2023 - Nov.2024) |

Total remuneration paid in FP45 - FP46 (Dec.2023 - Nov.2024) |

||

|---|---|---|---|---|---|---|---|---|---|

| Taxation, Finance and Accounting | Compliance and Risk Management | Real Estate | |||||||

| Executive Director | Aya Motomura Appointed in August 2019 |

Female | In addition to the knowledge and work experience she has gained as a legal expert, Ms. Motomura has a wealth of knowledge and experience concerning the real estate securitization service, general financial regulations on banks, trusts and gold commerce, as well as general corporate legal affairs. In addition, she was seconded to the Financial Service Agency, where she was involved in the revision of the Financial Instruments and Exchange Act, the Act on Investment Trusts and Investment Corporation, the Act on the Securitization of Assets, etc. | 〇 | 〇 | Lawyer | 100% | 5,004 thousand yen | |

| Supervisory Director | Noriyuki Katayama Appointed in August 2017 |

Male | In addition to knowledge and work experience he has gained as a legal expert, Mr. Katayama has developed his career as a legal counsel on real estate securitization. He also teaches securitization-related laws at a university business school. | 〇 | 〇 | Lawyer | 100% | 3,600 thousand yen | |

| Supervisory Director | Hiroyuki Owada Appointed in August 2023 |

Male | In addition to the knowledge and work experience he has gained as an expert in accounting, taxation and financing, Mr. Owada developed knowledge and experience on real estate. He also engages in a range of operations such as stock and business valuation, intangible asset valuation and financial due diligence. | 〇 | 〇 | Certified Public Accountant Certified Public Tax Accountant |

100% | 3,600 thousand yen | |

(Note 1) This table’s “Main Skills and Experience” column refers to each officer’s relatively distinctive experience and expertise. It does not represent all the knowledge and abilities possessed by each officer.

Auditor Remuneration

The Board of Directors determines the remuneration for the accounting auditor for each financial period subject to audit within a range no greater than 15 million yen.

This table can be scrolled sideways.

| Name | Remuneration details | Total remuneration paid in FP45 - FP46 (Dec.2023 - Nov.2024) |

|---|---|---|

| KPMG AZSA LLC | Remuneration based on audit services | 26,400 thousand yen |

(note 1)The total remuneration paid to the KPMG AZSA LLC includes compensation for services not covered under Article 2,Paragraph 1 of the Certified Public Accountants Act.(20 milion yen) There has been no payment of remuneration to any entities affiliated with the same network as the KPMG AZSA LLC.

Asset Management Fees for the Asset Management Company

Asset management fees for the Asset Management Company comprise Management Fee 1, Management Fee 2, Management Fee 3, Acquisition Fee, Transfer Fee and Merger Fee. The calculation methods and payment timings for each fee are given below.

This table can be scrolled sideways.

| Management Fees Structure |

Calculation Method / Maximum Amount |

|---|---|

| Management Fee 1 | For each business period, the maximum amount shall be the amount obtained by multiplying the total assets listed on the balance sheet at the end of the previous fiscal period (limited to those approved by the Board of Directors pursuant to Article 131, Paragraph 2 of the Investment Trust Act) by 0.30%, and multiplying that amount by the number of months in the business period divided by 12. The payment timing shall be within one month following approval of financial statements, etc. (meaning financial statements, asset investment reports and statements on the distribution of monies, and their annexed detailed statements as set forth in Article 129 of the Investment Trust Act; hereinafter the same) for the business period in question by the Board of Directors. |

| Management Fee 2 | For each business period, the maximum amount shall be the amount obtained by multiplying FFO (*1) for the business period in question by 4.50%. However, if there is an undisposed deficit for the period on the last day of the business period, there shall be no such compensation. *1: Funds From Operation (FFO) is the amount obtained by adding profit before the deduction of Management Fee 2 and Management Fee 3 (including expenses in the business period in question due to consumption tax and local consumption tax pertaining to these fees) to depreciation and amortization and an amount equivalent to loss on the transfer of managed assets (*2), and subtracting an amount equivalent to the gain on transfer of managed assets and gain on bargain purchase. However, if there is an undisposed deficit at the end of the previous business period, the amount shall be obtained by deducting that undisposed deficit from the above amount. *2: Managed assets refers to specific assets subject to asset management as set forth in Article 26 (however, this excludes securities described in Paragraph 4 of the same article [government securities, etc. only]). The payment timing shall be within one month following approval of financial statements, etc. for the business period in question by the Board of Directors. |

| Management Fee 3 | The maximum amount shall be the amount obtained by multiplying the dividend per investment unit related to the business period in question ("per unit dividend," hereafter) by 50,000. Here the per unit dividend is calculated by adding profit before deduction of Management Fee 3 (including expenses in the business period in question due to consumption tax and local consumption tax pertaining to this fee) to an amount equivalent to the reversal of retained earnings (excluding the amount equivalent to the reversal of retained earnings subject to the payment of Management Fee 2 in the past), and dividing that amount by the total number of investment units issued as of the end of the relevant business period.

Also note that when the number of investment units fluctuates due to the splitting or consolidation of investment units, from the business period during when the fluctuation in question occurred, the maximum amount shall be the amount obtained by multiplying the relevant percentage change by 50,000, and multiplying that figure by the per unit dividend. The payment timing shall be within one month following approval of financial statements, etc. for the business period in question by the Board of Directors. |

| Acquisition Fee | When managed assets have been newly acquired (except for succession based on an absorption type merger where the Investment Corporation is the surviving corporation), the maximum amount shall be the amount obtained by multiplying the acquisition price of the managed assets (*3) by 1.00%.

Note that when managed assets have been obtained from an interested party ("interested person or other close affiliate" as defined in Article 201, Paragraph 1 of the Investment Trust Act and each item of Article 123 of the Enforcement Order of the Investment Trust Act, a company or other party holding more than 10% of the voting rights of all shareholders of the Asset Management Company, a company or other party holding more than 50% of the voting rights of all shareholders of such a company, or any company or other party engaged in providing advice, etc. regarding the investment or management of said assets; hereinafter the same), the maximum amount shall be the total amount obtained by multiplying the above percentages by one-half. *3: The acquisition price shall be the amount listed in the purchase agreement, and shall exclude consumption tax, local consumption tax and costs associated with the acquisition. The payment timing shall be the end of the month following the month in which the managed asset acquisition date falls. |

| Transfer Fee | When managed assets have been transferred (excluding succeeded assets in an absorption-type merger in which the Investment Corporation is extinguished in the merger, or in an incorporation type merger), the maximum amount shall be the amount obtained by multiplying the transfer price of the managed assets (*4) by 1.00%, or by multiplying the capital gains of each transferred asset (*5) by one-half, whichever amount is the smallest.

Note that when managed assets have been transferred to an interested party, the maximum amount shall be the amount obtained by multiplying the transfer price of the managed assets by 0.50%, or by multiplying the capital gains of each transferred asset by one-half, whichever amount is the smallest. Additionally, in each of these cases, no transfer fees shall arise for the transfer of managed assets that result in a loss on transfer. *4: The transfer price shall be the amount listed in the purchase agreement, and shall exclude consumption tax, local consumption tax and costs associated with the transfer. *5: Gain on transfer is the difference when the transfer price exceeds the book value of the managed asset at the time of transfer. The payment timing shall be the end of the month following the month in which the managed asset transfer date falls. |

| Merger Fee | When an absorption-type merger is carried out with another investment corporation in which the Investment Corporation is the surviving corporation, the maximum amount shall be the amount obtained by multiplying the appraised value of the assets to be succeeded by the Investment Corporation due to the merger as of the effective date of the merger by 1.00%.

When an absorption-type merger is carried out with another investment corporation in which the Investment Corporation is the corporation extinguished in the merger, or when an incorporation-type merger is carried out, the maximum amount shall be the amount obtained by multiplying 1.00% by the appraised value at the effective time of the merger of those assets held by the counterparty and held as the surviving corporation, or the appraised value at the effective time of the merger of those assets that will be succeeded to the corporation established by the incorporation-type merger. Note that when a merger is carried out with an interested party, the maximum amount shall be the total amount obtained by multiplying each of the above percentages by one-half. The payment timing shall be within three months from the last day of the month in which the effective date of the merger falls. |

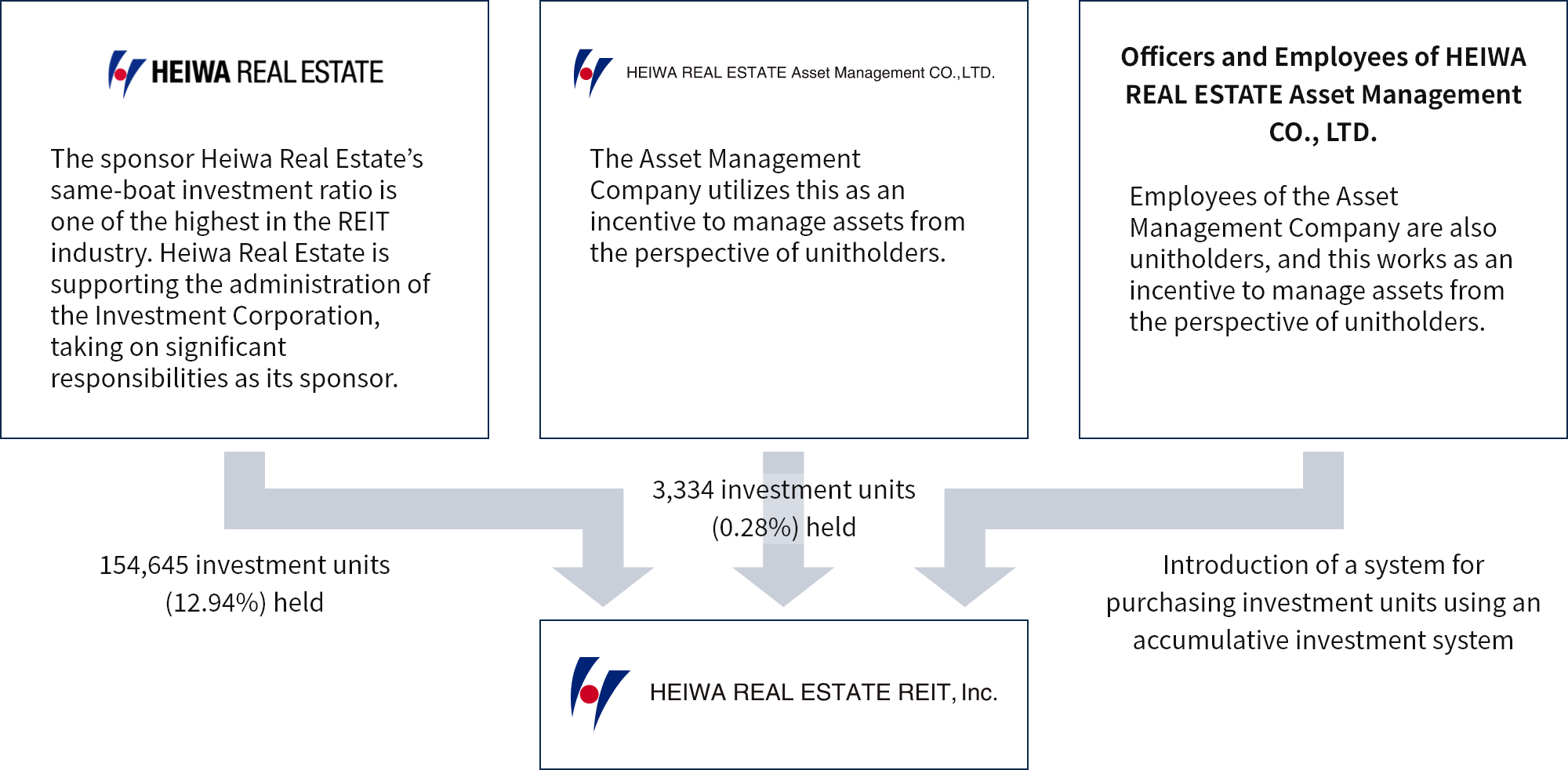

Three-Layered Same-Boat Investment

Restraints on Transactions with Stakeholders

- The scope of stakeholders, in addition to stakeholders, etc., stipulated in the Act on Investment Trust and Investment Corporations, is determined to include, pursuant to the Regulations to Prevent Acts in Conflict of Interest as internal regulations of the Asset Management Company, companies, etc., holding more than 10% of the voting rights of all shareholders in the Asset Management Company; companies, etc., in which such companies, etc., hold more than 50% of the voting rights of all their shareholders; and companies, etc., to which these parties provide advice and other services with regard to the management and maintenance of their assets.

- Regarding transactions with stakeholders, the Asset Management Company shall comply with relevant laws and regulations, etc., and engage only in transactions satisfying the terms stipulated in the Regulations to Prevent Acts in Conflict of Interest. In addition, in certain cases prescribed by the regulations of the Investment Corporation, proposals shall be submitted to the Investment Corporation and the approval of its Board of Directors obtained. When engaging in transactions with stakeholders as transactions satisfying the terms of regulations stipulated by the Investment Corporation, written notification shall be provided to the Investment Corporation without delay, while information pertaining to transactions conducted with stakeholders shall be disclosed pursuant to the Basic Information Disclosure Policy prescribed by the Asset Management Company.

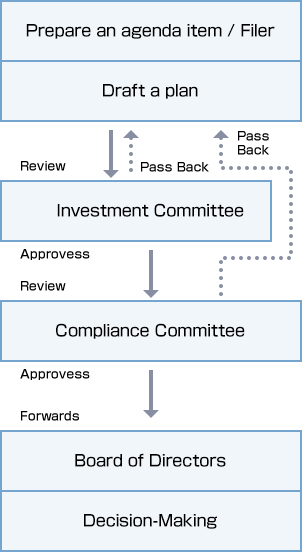

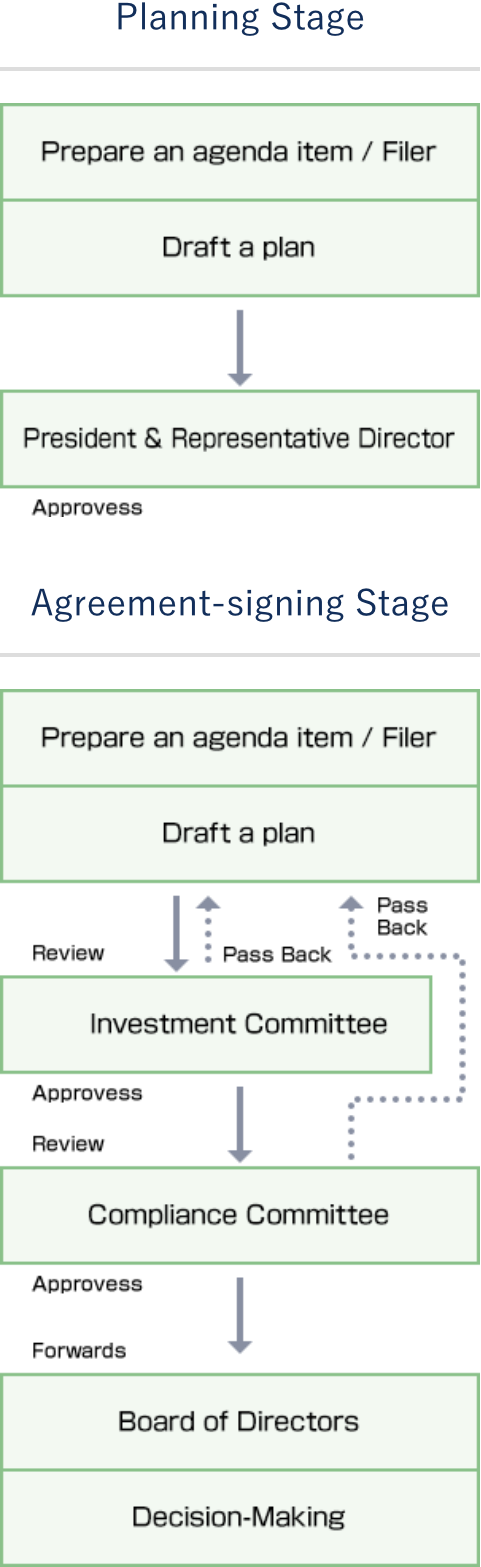

Investment Management Decision-Making Structure

(A)The following provides an overview of the process from preparing and submitting a review document for making decisions regarding assets under management to the decision itself:

- The General Manager of the Planning & Finance Department, the General Manager of the Office Asset Management Department and the General Manager of the Residence Asset Management Department prepare review documents for the said policy or plan for submission to the Investment Committee when establishing or altering the management guidelines, portfolio plans, current business plans, maintenance plans, etc.

- The Investment Committee deliberates the said policy or plan and if there are issues, it is returned to the head of the related division for revision(s). If the said policy or plan has passed through the Investment Committee, it shall be allowed to be submitted to the Compliance Committee.

- With respect to the said policy or plan which has passed through the Investment Committee, the Compliance Committee deliberates whether there are any compliance issues in light of related laws and regulations, the “Management Guidelines” and internal rules. Any measures judged to have issues during deliberations are returned to the General Manager of the related division for revision(s).

- The General Manager of the related division refers to the Board of Directors the policy or plan that has passed through the Compliance Committee and attaches results of deliberations conducted at sessions of the Investment Committee and Compliance Committee alongside it. The Board of Directors then makes a final decision concerning the said policy or plan.

(B)The following provides an overview of the process from preparing and submitting a review document for making decisions regarding acquisition or sale, etc. of assets under management:

- The General Manager of the Real Estate Investment Department creates an investment asset acquisition/sale review document for submission to the President and Representative Director, based on management guidelines, portfolio plans and current asset management plans.

- The chair of the Compliance Committee (Chief Compliance Officer) convenes a session of the Compliance Committee to verify whether there are any compliance issues (legal/regulatory) or transactions involving interested parties and HEIWA REAL ESTATE REIT, Inc.

- After approval by the President and Representative Director, the Real Estate Investment Department issues a Request for Settlement/Purchase Certificate or Sales Term Sheet, and begins negotiations with the seller or purchaser.

- The General Manager of the Real Estate Investment Department creates a review document for executing the purchase/sales agreement, and submits it together with a copy of the approved review document (2., above) to the Investment Committee.

- The Investment Committee deliberates on the results of due diligence and the terms of the transaction based on the internal approval memo referred to in the previous paragraph. Transactions deemed as having issues by the Investment Committee are sent back to the General Manager of the Investment Management Division for revision(s). Transactions that have passed through the Investment Committee are allowed to be submitted to the Compliance Committee.

- Based on internal approval memos that have passed through the Investment Committee and based on the results of due diligence and compliance check lists, the Compliance Committee deliberates that the details of the internal approval memo approved by the President and Representative Director and the actual agreement are consistent, and that the terms of the transaction are legal and appropriate. Transactions deemed as having compliance issues by the Compliance Committee are sent back to the General Manager of the Investment Management Division for revision(s). Transactions that have passed through the Compliance Committee are forwarded to the Board of Directors for a final decision.