Corporate Governance

Management of the Investment Corporation’s assets is entrusted to HEIWA REAL ESTATE Asset Management CO., LTD. (hereinafter referred to as the “Asset Management Company”). The Asset Management Company, recognizing that the management operations of the Investment Corporation’s assets comprise management of the capital of the Investment Corporation’s unitholders, determines various regulations and conducts decision-making procedures for the purpose of confirming the status of compliance with laws, regulations and other requirements, and for executing appropriate and fair business management.

Matters Pertaining to the Compliance Management System

- The Compliance Committee, acting with the Chief Compliance Officer as its chairperson, shall deliberate from perspectives including compliance and risk management with regard to transactions with stakeholders and other matters to be discussed, pertaining to the presence or absence of legal issues, whether the Asset Management Company is fulfilling its duties as the trustee of the asset management operations and other matters.

- In undertaking management of the compliance system, the Chief Compliance Officer shall render judgments on matters such as compliance with laws, regulations and other requirements and the handling of matters comprising violations, as well as prepare written opinions as deemed necessary when rendering judgments on compliance with laws, regulations and other requirements. As needed, furthermore, the opinions and judgments of the appropriate authorities and/or outside experts (attorneys at law, external auditors, etc.) and other actions shall be taken to implement and coordinate various measures for the purpose of promoting compliance.

- The Compliance/Risk Management Office shall implement monitoring of the status of compliance with laws, regulations and other requirements on a daily basis, as well as undertake the development and management of in-house regulations, respond to accidents, complaints and other matters and otherwise engage in management of all areas of risk, including compliance. In addition, in the interest of compiling knowledge regarding laws, regulations and other areas required by all department and offices, and to gain thorough awareness of the need for compliance, in-house training and other programs shall be implemented as required, in striving to develop and enhance the internal control program.

Restraints on Transactions with Stakeholders

- The scope of stakeholders, in addition to stakeholders, etc., stipulated in the Act on Investment Trust and Investment Corporations, is determined to include, pursuant to the Regulations to Prevent Acts in Conflict of Interest as internal regulations of the Asset Management Company, companies, etc., holding more than 10% of the voting rights of all shareholders in the Asset Management Company; companies, etc., in which such companies, etc., hold more than 50% of the voting rights of all their shareholders; and companies, etc., to which these parties provide advice and other services with regard to the management and maintenance of their assets.

- Regarding transactions with stakeholders, the Asset Management Company shall comply with relevant laws and regulations, etc., and engage only in transactions satisfying the terms stipulated in the Regulations to Prevent Acts in Conflict of Interest. In addition, in certain cases prescribed by the regulations of the Investment Corporation, proposals shall be submitted to the Investment Corporation and the approval of its Board of Directors obtained. When engaging in transactions with stakeholders as transactions satisfying the terms of regulations stipulated by the Investment Corporation, written notification shall be provided to the Investment Corporation without delay, while information pertaining to transactions conducted with stakeholders shall be disclosed pursuant to the Basic Information Disclosure Policy prescribed by the Asset Management Company.

Investment Management Decision-Making Structure

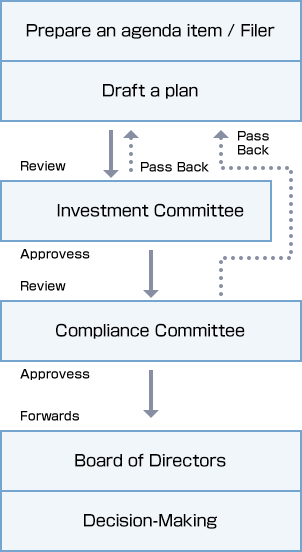

- The following provides an overview of the process from preparing and submitting a review document for making decisions regarding assets under management to the decision itself:

- The General Manager of the Planning & Finance Department, the General Manager of the Office Asset Management Department and the General Manager of the Residence Asset Management Department prepare review documents for the said policy or plan for submission to the Investment Committee when establishing or altering the management guidelines, portfolio plans, current business plans, maintenance plans, etc.

- The Investment Committee deliberates the said policy or plan and if there are issues, it is returned to the head of the related division for revision(s). If the said policy or plan has passed through the Investment Committee, it shall be allowed to be submitted to the Compliance Committee.

- With respect to the said policy or plan which has passed through the Investment Committee, the Compliance Committee deliberates whether there are any compliance issues in light of related laws and regulations, the “Management Guidelines” and internal rules. Any measures judged to have issues during deliberations are returned to the General Manager of the related division for revision(s).

- The General Manager of the related division refers to the Board of Directors the policy or plan that has passed through the Compliance Committee and attaches results of deliberations conducted at sessions of the Investment Committee and Compliance Committee alongside it. The Board of Directors then makes a final decision concerning the said policy or plan.

- The following provides an overview of the process from preparing and submitting a review document for making decisions regarding acquisition or sale, etc. of assets under management:

Planning Stage

Agreement-signing Stage

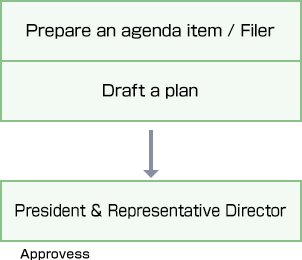

- The General Manager of the Real Estate Investment Department creates an investment asset acquisition/sale review document for submission to the President and Representative Director, based on management guidelines, portfolio plans and current asset management plans.

- The chair of the Compliance Committee (Chief Compliance Officer) convenes a session of the Compliance Committee to verify whether there are any compliance issues (legal/regulatory) or transactions involving interested parties and HEIWA REAL ESTATE REIT, Inc.

- After approval by the President and Representative Director, the Real Estate Investment Department issues a Request for Settlement/Purchase Certificate or Sales Term Sheet, and begins negotiations with the seller or purchaser.

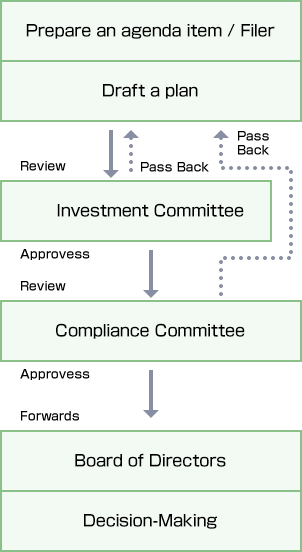

- The General Manager of the Real Estate Investment Department creates a review document for executing the purchase/sales agreement, and submits it together with a copy of the approved review document (2., above) to the Investment Committee.

- The Investment Committee deliberates on the results of due diligence and the terms of the transaction based on the internal approval memo referred to in the previous paragraph. Transactions deemed as having issues by the Investment Committee are sent back to the General Manager of the Investment Management Division for revision(s). Transactions that have passed through the Investment Committee are allowed to be submitted to the Compliance Committee.

- Based on internal approval memos that have passed through the Investment Committee and based on the results of due diligence and compliance check lists, the Compliance Committee deliberates that the details of the internal approval memo approved by the President and Representative Director and the actual agreement are consistent, and that the terms of the transaction are legal and appropriate. Transactions deemed as having compliance issues by the Compliance Committee are sent back to the General Manager of the Investment Management Division for revision(s). Transactions that have passed through the Compliance Committee are forwarded to the Board of Directors for a final decision.

- Processes for deciding the execution of management or leasing of investment assets, or any other processes that are not referred to under 2. of these Guidelines, shall follow investment asset management bylaws and other related bylaws.